CCC has partnered with Bluefin, a leading provider of payment security solutions for U.S. and Canadian merchants, to provide the security and PCI scope reduction of Bluefin’s PCI-validated P2PE solution to our clients – with no change to their current CCC integration.

Benefits of the Bluefin P2PE Solution

PCI Scope Reduction

Reduce your PCI scope and annual attestation to a PCI P2PE self-assessment questionnaire (SAQ), with just 33 questions.

Cost Savings

Save time and money on your security environments including penetration testing, annual PCI audits, employee overhead, and firewalls.

Brand Protection

Data breaches that expose payment and sensitive data damage the brand, lower consumer confidence and can cost millions.

One-on-one Customer Support

CCC clients get one-on-one support through Bluefin’s customer service team.

Increase Device Security

PCI P2PE certified devices are more secure and are designed to detect tampering. If malicious activity is detected, the device is automatically deactivated, preventing a breach at the point of entry device.

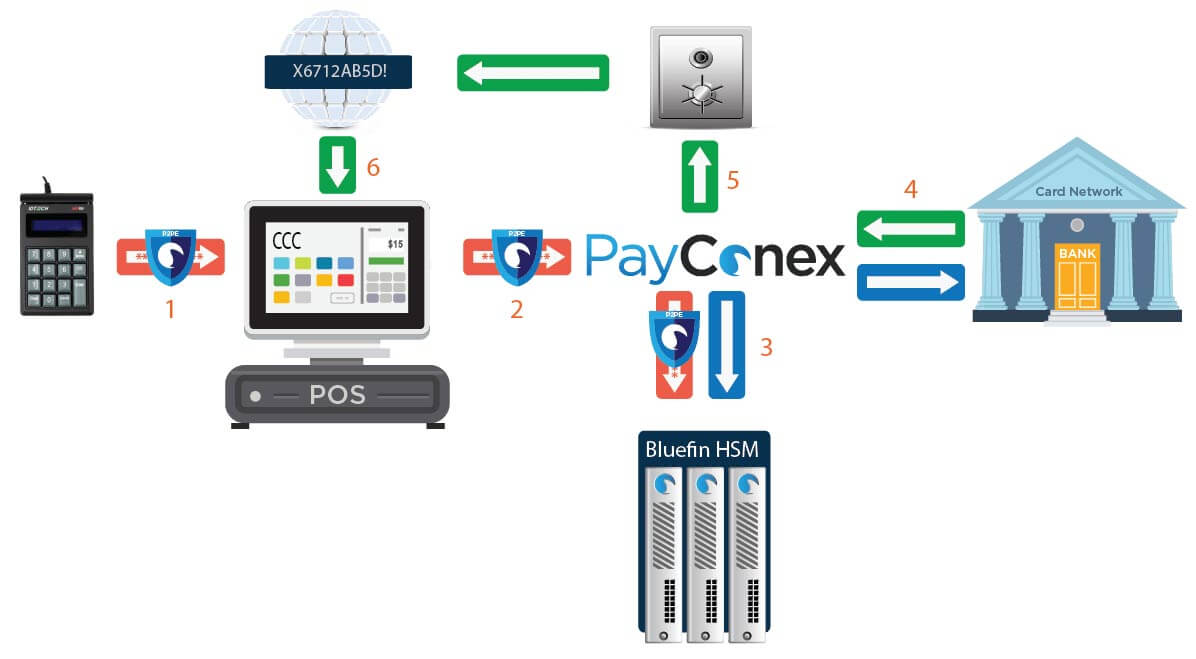

How Does Point-To-Point Encryption (P2PE) Work?

- Payment terminal encrypts the data and sends it to CCC

- CCC sends the encrypted data to Bluefin

- Bluefin decrypts the data in our HSM and sends it to the card network for authorization

- The network sends the authorization back to Bluefin

- Bluefin sends the data to its token vault

- Bluefin returns a token to the CCC software for recurring payments

Payments and Security in a Complete Package

Get Started

Contact Us

Let Bluefin and CCC protect your YMCA/YWCA/JCC and members payment transactions.